The cryptocurrency landscape has witnessed an exponential surge in interest and adoption over the past decade, with Bitcoin, Ethereum, and other digital currencies capturing the attention of investors, businesses, and even governments worldwide. While the potential of crypto to revolutionize financial systems and empower individuals is undeniable, its volatility, security concerns, and regulatory uncertainties have raised questions about its suitability for the average person.

Crypto’s Potential Benefits for the Common Man

Cryptocurrency offers several potential benefits for the common man, particularly in areas where traditional financial systems are inaccessible or inefficient. For instance, crypto can provide:

- Financial Inclusion: Cryptocurrencies can enable individuals in unbanked or underbanked regions to access financial services, such as remittances and payments, without the need for traditional intermediaries like banks.

- Transparency and Security: Crypto transactions are recorded on a public blockchain ledger, ensuring transparency and immutability. This can help reduce fraud and financial crimes.

- Global Reach: Cryptocurrencies are borderless, allowing for seamless and low-cost transactions across the globe. This can be particularly beneficial for businesses and individuals engaged in international trade or remittances.

Crypto’s Demerits and Real-World Impacts

Despite its potential benefits, crypto also carries several risks that could negatively impact the common man. These include:

- Volatility: Cryptocurrencies are highly volatile, with prices experiencing significant fluctuations. This volatility can lead to significant losses for investors.

- Security Concerns: Crypto wallets and exchanges have been targeted by hackers, resulting in thefts of digital assets. These incidents raise concerns about the security of crypto investments.

- Regulatory Uncertainties: The regulatory landscape for cryptocurrencies is still evolving, with governments worldwide grappling with how to regulate this new asset class. This uncertainty can create challenges for businesses and individuals operating in the crypto space.

Real-World Examples of Crypto’s Demerits

The rollercoaster nature of crypto prices has left many investors with substantial losses. For instance, the recent collapse of TerraUSD, a stablecoin pegged to the US dollar, wiped out billions of dollars in investor value.

Security breaches have also wreaked havoc on the crypto industry. In 2016, the Mt. Gox exchange was hacked, resulting in the theft of over 750,000 bitcoins, worth billions of dollars at the time.

The lack of clear regulatory guidelines has also created challenges for crypto businesses. In China, the government’s crackdown on crypto mining and trading has forced many businesses to relocate or shut down.

Scope of Crypto in the Future

Despite the challenges, crypto is still in its early stages of development, and its potential impact on the global financial system is immense. As technology advances and regulatory frameworks mature, crypto has the potential to:

- Facilitate faster, cheaper, and more secure cross-border payments.

- Provide new investment opportunities and democratize access to financial markets.

- Empower individuals with greater control over their finances.

How Crypto Businesses Have Misguided Investors as an Evolved MLM

Cryptocurrencies have taken the world by storm in recent years, and many people are eager to get involved in this exciting new technology. However, some crypto businesses have taken advantage of this enthusiasm by using misleading and deceptive tactics to attract investors. These tactics are often similar to those used by multi-level marketing (MLM) schemes.

MLMs are a business model in which participants earn money not only by selling products or services, but also by recruiting new participants into the scheme. This can create a pyramid-like structure in which the only people who make money are those at the top.

Crypto businesses have used a number of MLM-like tactics to mislead investors, including:

- Promising high returns with little or no risk: Crypto businesses often promise investors that they can make a lot of money quickly and easily with little or no risk. However, this is simply not true. Cryptocurrencies are a volatile asset class, and prices can fluctuate wildly. Investors should be prepared to lose money when investing in crypto.

- Using social media influencers to promote their schemes: Crypto businesses often use social media influencers to promote their schemes. These influencers often have a large following of people who trust their recommendations. However, it is important to remember that influencers are often paid to promote these schemes, and they may not have the best interests of investors at heart.

- Making false or misleading claims about their products or services: Some crypto businesses make false or misleading claims about their products or services in order to attract investors. For example, some businesses may claim that their product is guaranteed to make money, or that it is backed by a major financial institution. These claims are often false, and investors should always do their own research before investing in any crypto business.

Unauthorized MLM Models of Crypto Business

Unauthorized MLM models of crypto business are particularly dangerous because they are not subject to the same regulations as legitimate businesses. This means that investors are at a much greater risk of being scammed.

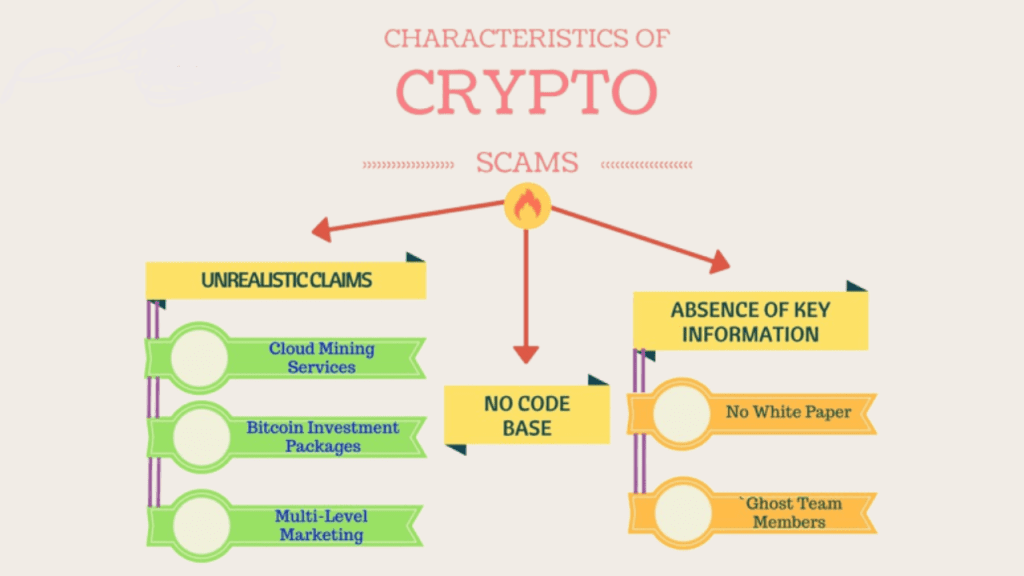

Some of the red flags of an unauthorized MLM model of crypto business include:

- A focus on recruitment over product sales: If a crypto business is more focused on recruiting new investors than on selling products or services, it is likely a scam.

- Unrealistic promises of high returns: If a crypto business is promising investors high returns with little or no risk, it is likely a scam.

- A lack of transparency: If a crypto business is not transparent about its operations or its financials, it is likely a scam.

How to Avoid Crypto Scams

There are a number of things that investors can do to avoid crypto scams, including:

- Doing their own research: Before investing in any crypto business, it is important to do your own research and make sure that you understand the risks involved.

- Being wary of social media influencers: Do not be swayed by social media influencers who are promoting crypto businesses. Remember that these influencers are often paid to promote these schemes, and they may not have the best interests of investors at heart.

- Only investing money that you can afford to lose: Cryptocurrencies are a volatile asset class, and prices can fluctuate wildly. Only invest money that you can afford to lose.

- Never investing in a business that you do not understand: If you do not understand how a crypto business works, do not invest in it. There are many legitimate crypto businesses out there, but there are also many scams. It is important to be able to tell the difference.

Conclusion: Crypto – A Double-Edged Sword

Cryptocurrency presents a double-edged sword for the common man, offering both potential benefits and significant risks. While it has the potential to revolutionize financial systems and empower individuals, its volatility, security concerns, and regulatory uncertainties cannot be ignored. It is crucial for individuals to carefully consider these risks before investing in cryptocurrencies or engaging in crypto-related activities.

Moreover, as the crypto ecosystem continues to evolve, it is essential for governments and regulatory bodies to establish clear and effective frameworks to protect consumers and promote responsible innovation. Only through a balanced approach that addresses both the risks and opportunities of crypto can we ensure that this transformative technology benefits society as a whole.

Looking to read more interesting and mind blowing technology Insights; Subscribe :Reality vs. Enhancement: Google’s AI-Powered Photo Tools Raise Ethical Questions